英语原文共 18 页,剩余内容已隐藏,支付完成后下载完整资料

What can China learn from Australiarsquo;s Federal Government Budget Management System?

1 99 Shangda Road, BaoShan District, Shanghai, China

Keywords: Government budget, Budget management

Abstract. Since Australia is one of the British Commonwealth countries, it basically followed the British budget system. However, after several yearsrsquo; reform and innovation considering its national conditions, Australia has formatted quite a distinctive government budget system. Through the research and analysis of Australian government budget management system, this essay aims to put forward some new ideas and suggestions for the Chinese government budget management system which is helpful to Chinarsquo;s political reform and economic development.

Introduction

Government budget refers to a nationrsquo;s basic annual expenses and receipts plan of its public finance, and the modern government budget management system originated from England in seventeenth century. At that time, the development of capitalist economy has resulted in government funding expansion, so the public finance income and expenses is increasing rapidly. In order to make use of fiscal funds efficiently, government budget is created as the times require and plays a more important role than ever. Now it has become a core issue in national finance management. The overall goal of modern government budget management is to improve the utilization efficiency of national public finance management and to make the state of public finances distributed in all levels of government and between different geographic areas equally.

There are various government budget management systems all over the world because of different historical backgrounds, social systems and different patterns of economic development. As one of the British Commonwealth countries, Australia originally followed the British budget system. However, after several yearsrsquo; reform and innovation considering its national conditions, it has formatted quite a distinctive government budget system. The following sections of this report will present and analyze Australian government budget management system, to make some new ideas and suggestions for the Chinese government budget management system which is helpful to Chinarsquo;s political reform and economic development.

Australian Federal Government Budget Management Functional Organizations

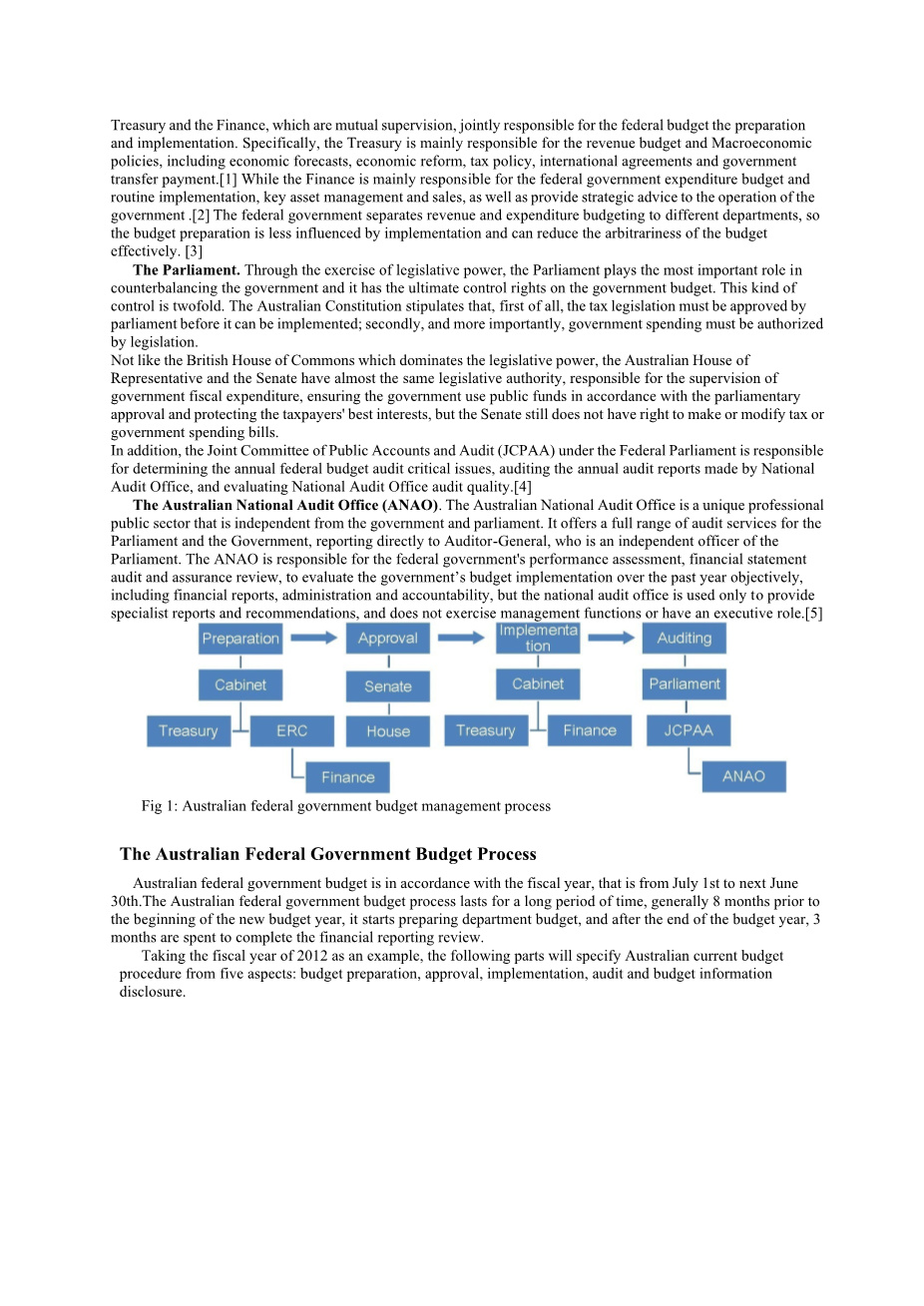

The administrative and legislative branches of the Federal Government of Australia share the budget management functions. The administrative branch is responsible for the preparation and implementation of budget, and the legislative branch is responsible for approving and auditing part. Its biggest feature is the clear division of responsibities which can effectively avoid the excessive concentration of power. This embodies the idea of separation and balances of powers, to closely monitor and control the entire budget process. Management of the federal governments budget is mainly related to three organizations: the Cabinet, Parliament and the National Audit Office. The three have different emphases, performed jointly by the federal government budget management functions.

The Cabinet. From the British budget system, the Cabinet has the absolute control of government budget, which improves government work efficiency and financial freedom to some extent. But unlike the British HM Treasuryrsquo;s taking everything on budget preparation and implementation, the Australian federal government cabinet separates the authority into two independent departments, the

Treasury and the Finance, which are mutual supervision, jointly responsible for the federal budget the preparation and implementation. Specifically, the Treasury is mainly responsible for the revenue budget and Macroeconomic policies, including economic forecasts, economic reform, tax policy, international agreements and government transfer payment.[1] While the Finance is mainly responsible for the federal government expenditure budget and routine implementation, key asset management and sales, as well as provide strategic advice to the operation of the government .[2] The federal government separates revenue and expenditure budgeting to different departments, so the budget preparation is less influenced by implementation and can reduce the arbitrariness of the budget effectively. [3]

The Parliament. Through the exercise of legislative power, the Parliament plays the most important role in counterbalancing the government and it has the ultimate control rights on the government budget. This kind of control is twofold. The Australian Constitution stipulates that, first of all, the tax legislation must be approved by parliament before it can be implemented; secondly, and more importantly, government spending must be authorized by legislation.

Not like the British House of Commons which dominates the legislative power, the Australian House of Representative and the Senate have almost the same legislative authority, responsible for the supervision of government fiscal expenditure, ensuring the government use public funds in accordance with the parliamentary approval and protecting the taxpayers best interests, but the Senate still does not have right to make or modify tax or government spending bills.

In addition, the Joint Committee of Public Accounts and Audit (JCPAA) under the Federal Parliament is responsible for determining the annual federal budget audit critical issues, auditing the annual audit reports made by National Audit Office, and evaluating National Audit Office audit quality.[4]

The Australian National Audit Office (ANAO). The Australian National Audit Offic

剩余内容已隐藏,支付完成后下载完整资料

资料编号:[236404],资料为PDF文档或Word文档,PDF文档可免费转换为Word