英语原文共 7 页,剩余内容已隐藏,支付完成后下载完整资料

International Diversification strategy of the leading Media Conglomerates

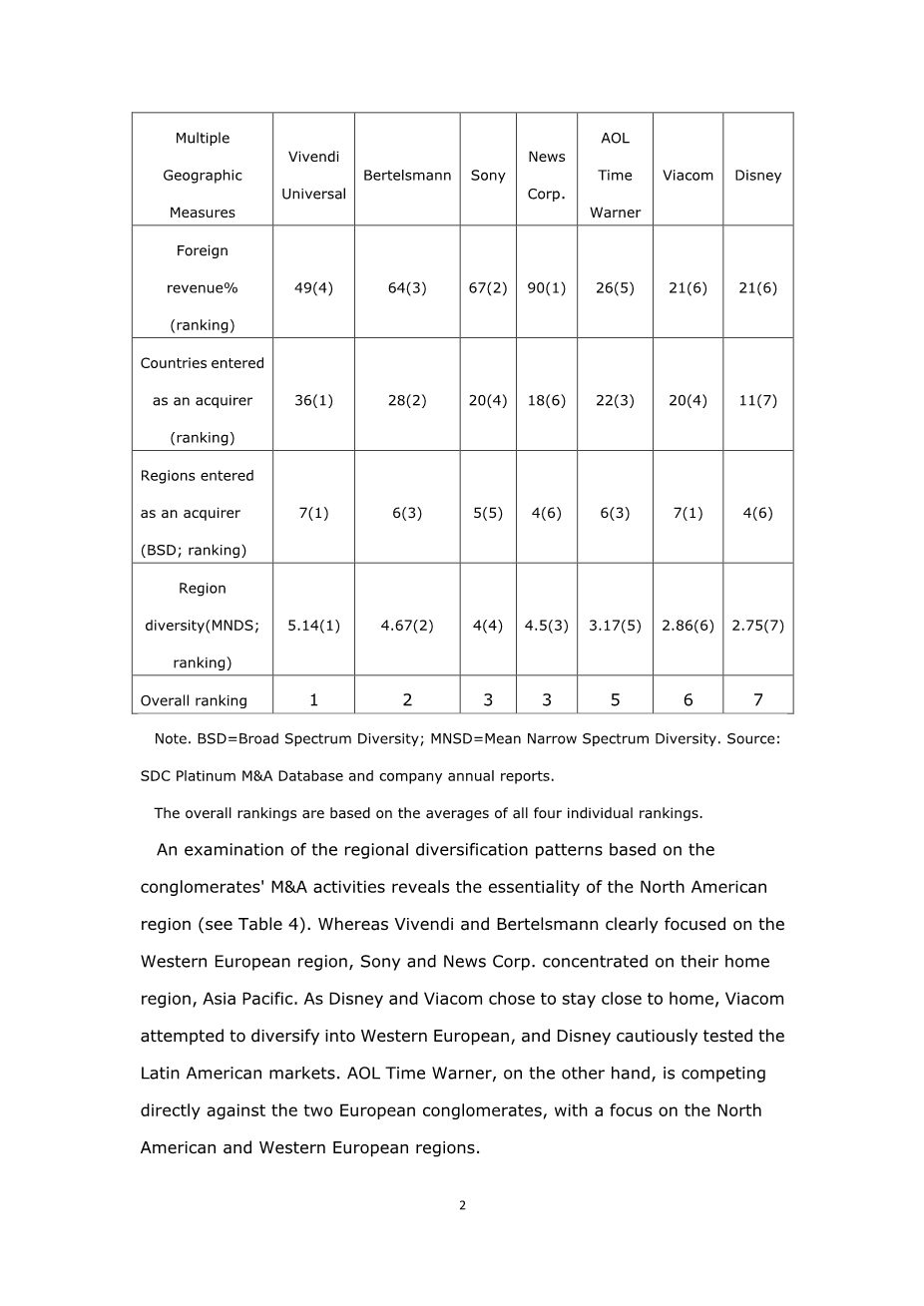

In terms of the extent and mode of international diversification, according to the percentage of revenues a conglomerates received from its international operations, News Corp., an Australian firm, and Sony, a Japanese corporation, were the most diversified, followed by Bertelsmann and Vivendi Universal. (see Table 3). Based on the number of countries the conglomerates have entered in the last 10 years as an acquirer via mergers and acquisition, Vivendi Universal was the most aggressive, followed by Bertelsmann and AOL Time Warner. Disney was the most conservative conglomerate in this regard, entering less than one third of the countries as Vivendi Universal. Table 2 shows the aggressiveness of Vivendi Universal and Bertelsmann, and, to some degree, Sony and News Corp., when we compared the differences in the numbers of international versus domestic Mamp;A transactions. Disney and Viacom were the most passive in this period, and AOL Time Warner was also not as aggressive as other international heavyweights in terms of the level of international Mamp;A activities.

As for the direction/relatedness of international diversification, based on the geographic BSD and MNDS indices, Vivendi Universal and Bertelsmann have adopted a less related geographic diversification approach, whereas Disney has clearly preferred geographic relatedness (see Table 1). In essence, we found that the European group of Vivendi Universal and Bertelsmann was overall least concerned with the geographic relatedness factor, whereas the pacific group of Sony and News Corp. opted for country diversity in related regions. The U.S. group, on the other hand, has various degrees of geographic relatedness preferences.

TABLE 3

International Diversification of Global Media Conglomerates

|

Multiple Geographic Measures |

Vivendi Universal |

Bertelsmann |

Sony |

News Corp. |

AOL Time Warner |

Viacom |

Disney |

|

Foreign revenue% (ranking) |

49(4) |

64(3) |

67(2) |

90(1) |

26(5) |

21(6) |

21(6) |

|

Countries entered as an acquirer (ranking) |

36(1) |

28(2) |

20(4) |

18(6) |

22(3) |

20(4) |

11(7) |

|

Regions entered as an acquirer (BSD; ranking) |

7(1) |

6(3) |

5(5) |

4(6) |

6(3) |

7(1) |

4(6) |

|

Region diversity(MNDS; ranking) |

5.14(1) |

4.67(2) |

4(4) |

4.5(3) |

3.17(5) |

2.86(6) |

2.75(7) |

|

Overall ranking |

1 |

2 |

3 |

3 |

5 |

6 |

7 |

Note. BSD=Broad Spectrum Diversity; MNSD=Mean Narrow Spectrum Diversity. Source: SDC Platinum Mamp;A Database and company annual reports.

The overall rankings are based on the averages of all four individual rankings.

An examination of the regional diversification patterns based on the conglomerates#39; Mamp;A activities reveals the essentiality of the North American region (see Table 4). Whereas Vivendi and Bertelsmann clearly focused on the Western European region, Sony and News Corp. concentrated on their home region, Asia Pacific. As Disney and Viacom chose to stay close to home, Viacom attempted to diversify into Western European, and Disney cautiously tested the Latin American markets. AOL Time Warner, on the other hand, is competing directly against the two European conglomerates, with a focus on the North American and Western European regions.

The Probable Link Between International Product Diversification and Performance

Figure 1 shows the relative degree of international product diversification for the leading global media conglomerates. Vivendi Universal and Bertelsmann have exhibited high levels of both products and geographic diversity. On the other hand, Viacom and Disney have been relatively conservative in diversifying, especially in regard to international diversification. In general, we found three apparent clusters of conglomerates based on their relative international product diversification strategy: the highly diversified European group of Vivendi Universal and Bertelsmann; the less diversified group of News Corp., Viacom, and Disney; and the middle-of-the-road group of Sony and AOL Time Warner. Of interest, while Sony was the least diversified conglomerate when only the media sectors were considered, AOL Time Warner was exactly the opposite. Table 5 shows the average performance of the leading conglomerates. Excluding Vivendi Universal#39;s environmental and Sony#39;s electronic assets, AOL Time Warner had the highest total sales revenues and the highest average growth rate. Disney, although generating relatively good sales revenues, had the lowest growth rate. Bertelsmann, on the other hand, had the second highest growth rate with modest total sales. Sony had perhaps the worst performance in regard to sales and sales growth. As far as profitability is concerned, Disney was the best performer, followed by Viacom, News Corp., AOL Time Warner, Sony, Vivendi Universal, and Bertelsmann, in that order. In regard to the measures of management effectiveness, AOL Time Warner was the leading performer.

Table 4

International Diversification of Global Media Conglomerates by Regions According to Mamp;A Activities

Note. Mamp;A=mergers and acquisitions. Source: SDC Platinum Mamp;A Database.

|

Region lt;全文共17367字,剩余内容已隐藏,支付完成后下载完整资料 资料编号:[154382],资料为PDF文档或Word文档,PDF文档可免费转换为Word |