Analysis and forecasts of investment scale and structure in upstream sector for oil companies based on system dynamics

Abstract: Oil and gas exploration and production is the most important and key segment in the whole business chain of the petroleum industry. Therefore, oil companies always put much emphasis on making scientific and reasonable decisions about investment scale and structure in the upstream sector, so that they can minimise business risks and obtain high returns. According to the system dynamics theories and methods and based on the actual results from an oil company’s practice in China, a system dynamics model is built in this paper for analyzing and forecasting the upstream investment scale and structure for an oil company. This model was used to analyze the investment effect of a large oil company in China, and the results showed that the total upstream investment scale will decline slowly in a short period and the investment proportion of different parts should be adjusted if some influencing factors are taken into account. This application practice was compared with the actual data and indicated that the system dynamics (SD) model presented in this paper is a useful tool for analyzing and forecasting of upstream investment scale and structure of oil companies in their investment decisions.

Keywords: Oil companies, upstream investment, scale and structure, analysis and forecast, system dynamics

1 Introduction

Because of past high oil prices, all the oil companies concentrate their investment on the upstream business and increase the investment strength in oil and gas exploration and development. So, the oil companies pay much attention to the analysis and forecast of upstream investment in terms of scale and structure and then they can take corresponding measures to adjust it according to the changing situations. Many methods are available as analyzing and forecasting methods, such as time series analysis, regression analysis and econometric methods. The System Dynamics (SD) method is often selected for complicated systems, because this method is specially designed for simulating and studying complex systems with multivariable, nonlinear and dynamic characteristics.

The SD method has been used in many cases for analyzing sustainable energy development in China (He et al, 2001; Zhang et al, 2006; Wu et al, 1998; Li et al, 2006; Song et al, 2004; Liu et al, 2004). The SD model was used in agricultural area to study the possible effects of methane utilization in rural areas (Tu and Jia, 2004). In the petroleum and petrochemical industry, the SD method was used for studying the capacity of the sustainable development of the energy industry (Wang et al, 2006; Li and Zhao, 2003; Tan et al, 2009), and for analyzing oil exploration and production and the effects of different government policies (Wang et al, 2001; Zhang et al, 2002; Chen et al, 2002). Some others (Yu et al, 2006; Yuan and Zhang, 2008; Wang et al, 2009; Li et al, 2009) have also undertaken related research work in the applications of system dynamics.

Based on the results from a consulting project in cooperation with a large oil company in China, this paper presents a simulation model, which is built by the SD method, for forecasting and analyzing the investment structure and scale in the upstream sector. After being examined, the model was used in simulating and analyzing the investment scale and structure in the upstream sector for the large oil company, and some suggestions were made on the basis of the simulation calculations.

2 Analysis of the oil company’s upstream investment and building of the system dynamics model

2.1 Analysis of oil company’s upstream investment and causality of the system dynamics

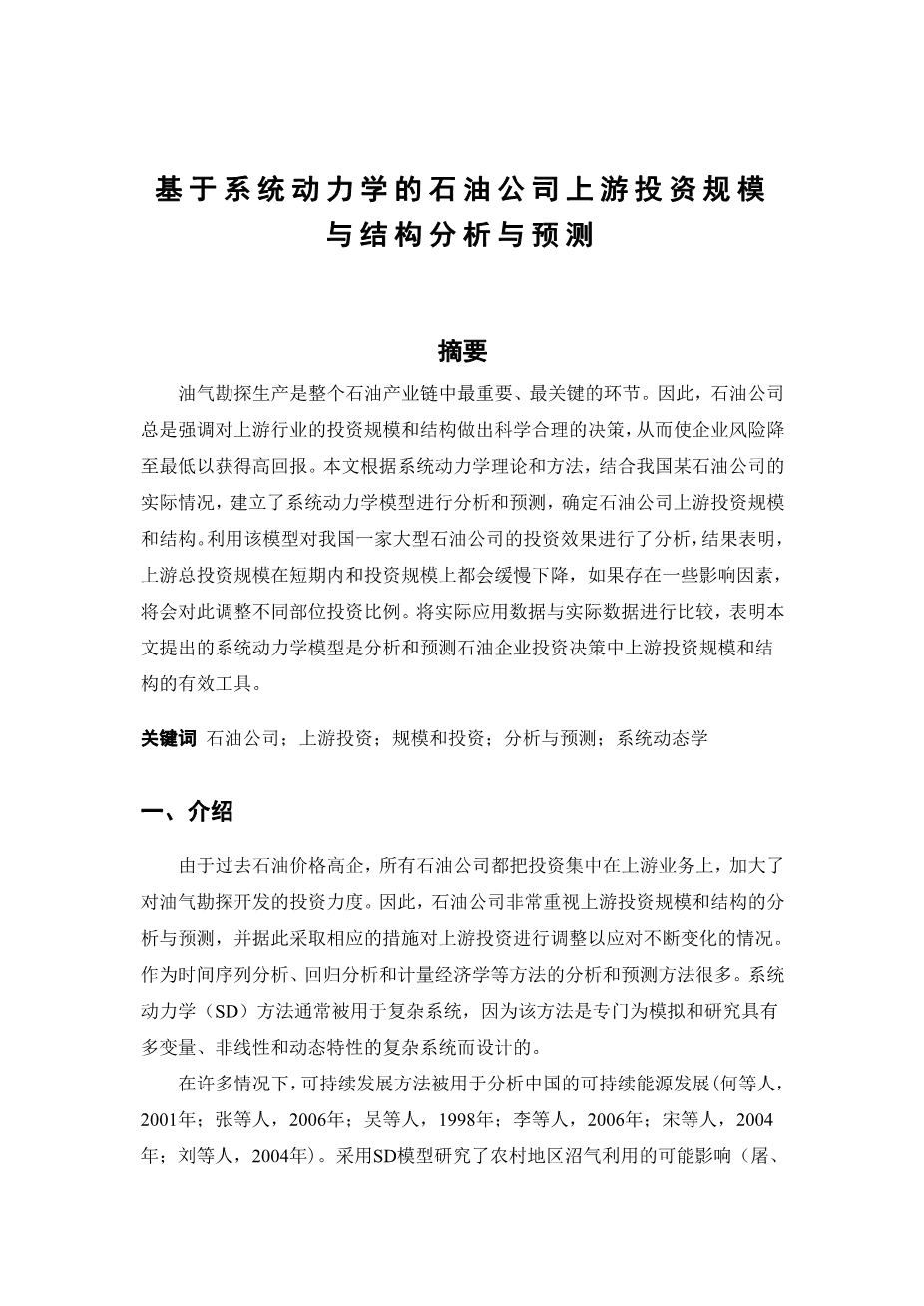

The upstream investment of an oil company is focused mainly on exploration and development of oil and gas. So,in this paper, the upstream investment system is divided into exploration and development subsystems. There are, of course, some other investments in upstream business, but we did not take them into account in our study. Based on the SD principles (Wang, 1994), we made a further study of the inter- relationship among various factors and feedback mechanism in the subsystems. Fig. 1 shows the brief causality among the factors in the exploration investment subsystem.

Fig. 1 Diagram of the causalities among the factors in the exploration subsystem

There are two feedback loops in Fig. 1, one is the causality feedback loop of geophysical and geochemical exploration investment, and the other is that of exploration well investment.

The first causality feedback loop shows that the company can add predicted reserves and controlled reserves by increasing investment in geophysical and geochemical exploration by the means of technical innovation and introducing new equipment. The remaining geological reserves will decrease over time, and then the accumulated remaining geological reserves will decline. With the decrease of the remaining geological reserves, the newly increased geological reserves will decrease. Thus, the company will reduce investment in geophysical and geochemical exploration, and increase investment in exploration wells in order to add the reserves further.

From the second causality feedback loop, it can be seen that the company may put more investment in exploration (including drilling more exploration wells) for the purpose of increasing proved reserves. With increasing proved reserves, the remaining geological reserves will decrease and then the accumulated remaining geological reserves will decrease. Owing to decreasing reserves and increasing difficulty in operati

剩余内容已隐藏,支付完成后下载完整资料

英语译文共 17 页,剩余内容已隐藏,支付完成后下载完整资料

资料编号:[465714],资料为PDF文档或Word文档,PDF文档可免费转换为Word